develop the skills to oversee all the verticals of your business, from hiring and policy setting to marketing, brand management, product development, and Customer Engagement Solutions services.

However, financial management is one of the most critical skills that will determine your business’s survival and success. You can learn financial management skills as well as marketing, and sales through Russell Brunson Books.

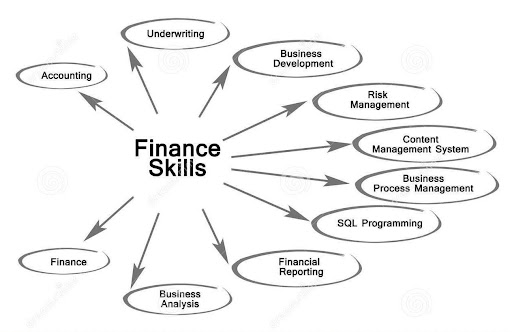

We have seen some of the country’s top industry leaders juggle many roles in their organizations. One of the most common mistakes that entrepreneurs, business leaders, and managers make is that financial skills do not matter much, particularly if they are not financed professionals or hire employees to manage the organization’s finances. However, since every business decision in an organization comes with a financial implication, you can hardly ignore the fiscal aspect of the business. Therefore, every business leader must put in the effort to master basic financial skills that will determine the success and growth of the enterprise.

- Forecasting – Forecasting is an all-encompassing term, but it is the very foundation of any business. When a business leader masters financial forecasting, it allows him or her to predict the course of the business and the industry as well. The availability of tech tools and abundant qualitative and quantitative data can help leaders understand future sales and turnovers. We have seen some of the top finance personalities in India, such as Sanjiv Bajaj of Bajaj Finserv, use the power of financial forecasting to steer their business organizations through the economic crisis caused by the COVID-19 pandemic.

- Business Funding – Sourcing and securing funding is one of the most important goals of a business leader. Looking at the industry leaders list in India will reveal entrepreneurs who have mastered this skill. While several traditional and non-traditional sources are available to the entrepreneur today, the secret to success remains in developing a robust business plan that encompasses realistic goals and growth plans. This involves an in-depth analysis of the fiscal aspect of the business and combining it with credit management skills. Narayan Murthy, the co-founder of Infosys, is one of the leaders constantly upskilling and has inspired aspiring entrepreneurs looking to hone their skills. He says that learnability is the most important quality to adapt to the fast-changing businesses and technology environment.

- Accounting – Understanding the company’s financials is one of the important goals you must set yourself as a leader. Accounting will help you understand the financial inflow and outflow of the business. The credits and debits will accurately reflect the assets and liabilities of the company and give a true picture of the financial loopholes that need to be plugged in. This will help you make smart financial decisions and help improve efficiencies across various departments.

Ratio Analysis – Ratio analysis is the next step to understanding your company’s financial statement. It helps you decode the company’s liquidity, operational efficiency, productivity, and profitability. Some of the famous financial leaders of India, such as Sanjiv Bajaj, have often highlighted the need for understanding and decoding the ratio analysis. This is the greatest tool for a business leader to make a course correction well ahead of a serious impact on the business and its fiscal viability.

- Budgeting and Investing – Budgeting and investing are complementary to each other. Budgeting helps a business leader understand how the company’s capital is spent to optimise efficiencies. It requires careful planning, the use of available data, and a thorough understanding of the business processes themselves. Investing typically occurs when growth and profitability are recorded, but it also feeds into planning for future development and expansion. More than anything, budgeting and investing require the business leader to develop a vision for the future.

Financial skills are part of every business leader’s toolkit. It is the very foundation of making smart decisions and guiding the organization to success and growth. Nithin Kamath, the founder and CEO of Zerodha, encourages business leaders and managers to develop financial skills to help take their businesses to the next level and grow in the current economic scenario. The modern-day business leader has several tech tools that help understand finances and forecasting. Leveraging this advantage is what will propel you and your organization forward.

Financial skills are part of a business leader’s toolkit. Every entrepreneur must learn and develop skills that will allow him or her to decode the company’s financial statements and financial growth. Every business decision that is made must have an inbuilt understanding of the financial implications. A dynamic business leader will learn to source funding and manage credit, read financial statements and accounts analysis, analyze the industry, economy, business forecasts, and budget, and invest efficiently.