Bonds today have become one of the most preferred options in the fixed income category. In comparison to bank FDs and investment in bonds provides you with better returns. Your investment in bonds comes with the liquidity feature so which you are allowed to sell bonds in the secondary market without additional cost. You also enjoy many other advantages over FDs.

BONDS – HIGHLIGHTS

- Low-risk investment avenues

- Fixed income with better returns

- A secondary source of income

Let us here learn about tax free bonds to find the answer to the question of how to buy tax free bonds online. without hassle.

What are tax free bonds?

Tax free bonds are the debt security issued by the government that is free from the obligation of paying income tax on the interest earned. It is issued with the objective of raising funds for a specific purpose. The interest on tax-free bond is non-taxable according to the Income Tax Act, 1961. It is a sound investment option so investors looking to save tax on their interest income.

For example, municipal bonds. The popular Tax-free bonds amongst investors in India are PFC, REC, NHAI, IRFC, HUDCO, and NABARD.

- · Tax free Bond are available for investment with a maturity of 10, 15, and 20 years.

- It provides more returns than tax-saving bonds

- The investment in Tax free Bond is limited to 5 lakh rupees.

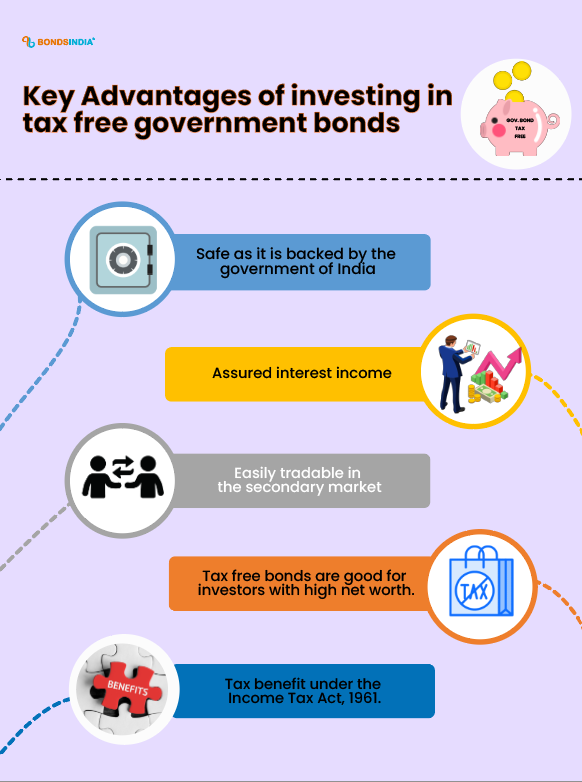

Key Advantages of investing in tax free government bonds

- Safe as it is backed by the government of India

- Assured interest income

- Easily tradable in the secondary market

- Tax free bond are good for investors with high net worth.

- Tax benefit under the Income Tax Act, 1961.

How to Buy Tax free Bonds Online?

Since Tax free Bonds are issued by the government, investors can buy tax free bonds at the time when the government opens the subscriptions. These bond are made available to the investors for a short period of time. To trade in tax free bonds online or offline, so you need to

complete your KYC successfully by using documents like Aadhar card/PAN card/Passport/Voter ID for verification.

You can invest online using your Demat account or trade using physical forms. Post issuance, so you can buy or sell tax-free bond in the secondary market through trading accounts. For more information https://northstarzone.com/

Features of tax-free bond

- Fixed income – Tax free fixed interest income.

- Dual form – it can be purchased online using your Demat account or can be bought directly offline.

- Multiple maturities – You can invest in tax-free bond with different maturities (10,15, or 20 years) so depending on your investment needs.

- Liquidity – these bond are easily tradable in the secondary market.

Bonds are fully tradable in the secondary market and are not chargeable on premature exit bond so they come with short-term, medium-term, and long-term maturity. Tax free bond come with multiple features and are known to provide advantages you cannot resist. You can invest in bonds with different maturities to fulfill your different financial goals in your life.